HOW TO USE OPTION SOFTWARE?

LET'S CHECK HOW TO USE SOFTWARE.

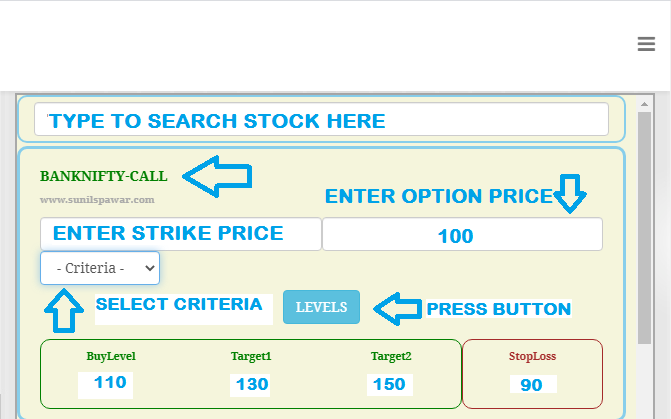

For simple understanding, let’s check above pic of our option software.

For example,

Banknifty call option’s current market price is 100.

Trader puts that price in software and selects other relevant options and press “get levels” button

Software gives result as

Buy level - 110

Target 1- 130

Target2- 150

Stoploss- 90

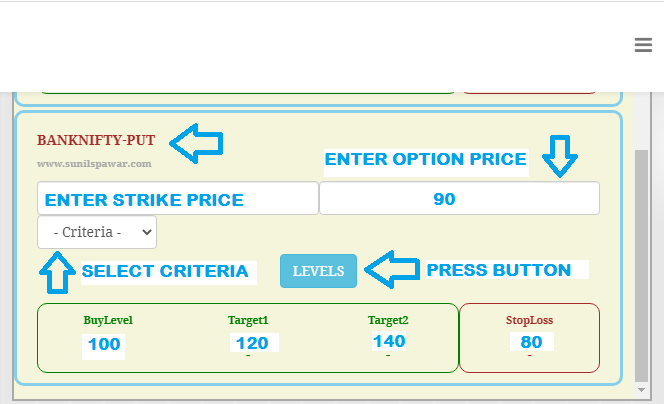

Also,

Banknifty put option’s current market price is 90.

Trader puts that price in software and selects other relevant options and press “get levels” button

Software gives result as

Buy level - 100

Target 1- 120

Target2- 140

Stoploss- 80

After this software gave the buy levels and targets for call option and put opton

There will be below possibilities

i) Call option may cross entry price and hit target – This type of trade is called as CALL TRADE

ii) Put option may cross entry price and hit target – This type of trade is called as PUT TRADE

iii) Call option may cross entry price but then it hit stoploss but Put option does not cross entry price and Call option again cross entry price –This type of trade is called as CALL CALL TRADE.

iv) Put option may cross entry price but then it hit stoploss but Call option does not cross entry price and Put option again cross entry price –This type of trade is called as PUT PUT TRADE.

v) Call option may cross entry price but hit stoploss and Put option may cross entry price and hit target- This type of trade is called as CALL PUT TRADE.

vi) Put option may cross entry price but hit stoploss and Call option may cross entry price and hit target- This type of trade is called as PUT CALL TRADE.

Vii) Call option may cross entry price but hit stoploss and then Put option may cross entry price but it also hit stoploss and lastly Call option may cross entry price and hit target – This type of trade is called as CALL PUT CALL TRADE.

viii) Put option may cross entry price but hit stoploss and then Call option may cross entry price but it also hit stoploss and lastly Put option may cross entry price and hit target – This type of trade is called as PUT CALL PUT TRADE.